It’s time to do an audit on your car insurance as well as your normal tax returns. Consumers think nothing of having a professional look over their tax return to ensure they have received every cent they have coming to them. Auto insurance policy holders should get in the spirit of tax season and conduct an audit on their coverage, asking important questions such as:

· Am I covered in the event I suffer injury in an accident?

· Are my passengers covered?

· Would I be able to recover anything in the event of a hit-and-run?

These are crucial questions, as the answers found in an audit on your car insurance can mean the difference between financial ruin and having the treatment and resources you need in the event of a catastrophic injury. Drivers are not getting any safer or less distracted, so it is in your best interest to make sure the answers are to your liking.

In the past it was not uncommon for the victims of hit-and-runs or drunk driving accidents to be left without the recovery they need to pay for medical costs, pain and suffering, lost earnings and other damages brought on by a motor vehicle accident.

Times have changed, as many auto insurance policies now include coverage that protects drivers in the event they are hurt by an underinsured or uninsured motorist. This coverage is only helpful if you have it, however, so it is crucial to make sure you have it. If you do not it can likely be purchased for a small fraction of your current premium’s cost.

In Kentucky, underinsured motorist coverage is mandatory, but you can opt-out of it in writing. Underinsured coverage is not mandatory, but has to be offered.

Kentucky is a no-fault insurance state, which means you are entitled to personal injury protection (PIP) funds in the event you are hurt. PIP is available to you regardless of fault for the accident. PIP covers lost wages (up to $200 per week) in addition to medical expenses. There are other benefits that may fit under no-fault payments such as replacement services. PIP is usually capped at $10,000, but that $10,000 can be extremely important as your medical expenses and other bills pile up after an accident. You can purchase, and we suggest purchasing, more PIP benefits than the basic $10,000.

You may think liability coverage is only applicable for a person you hit in an accident. In Kentucky your family members and passengers can file a claim against you if you are at fault for an accident where they are the passenger in the car. This is a very important distinction from surrounding states, allowing your family members to be compensated for your negligence if they are in the car.

An audit on your car insurance protects you in many common accident scenarios and provides peace of mind for a nominal cost. If you or someone you love has been injured in a motor vehicle accident we invite you to contact HLH or call (866) 583-9701 for a free consultation.

Louisville’s Most Established PI Firm

231 Breckenridge Lane, Suite 201

Louisville, KY 40207

Telephone: (502) 583-9701

Toll-Free: (866) 583-9701

Fax: 502-589-1144

Louisville Law Office Map

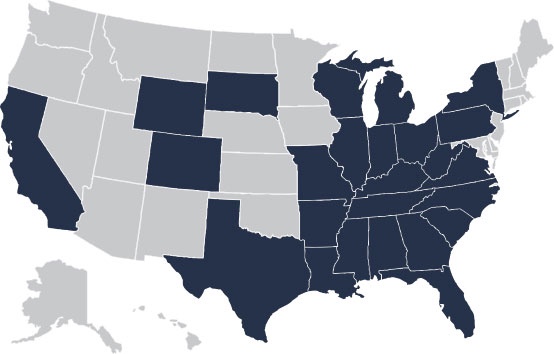

We've Handled All Types of Personal Injury Cases In The Following States as well as Canada and Mexico